Last Updated on May 22, 2025 by Deon

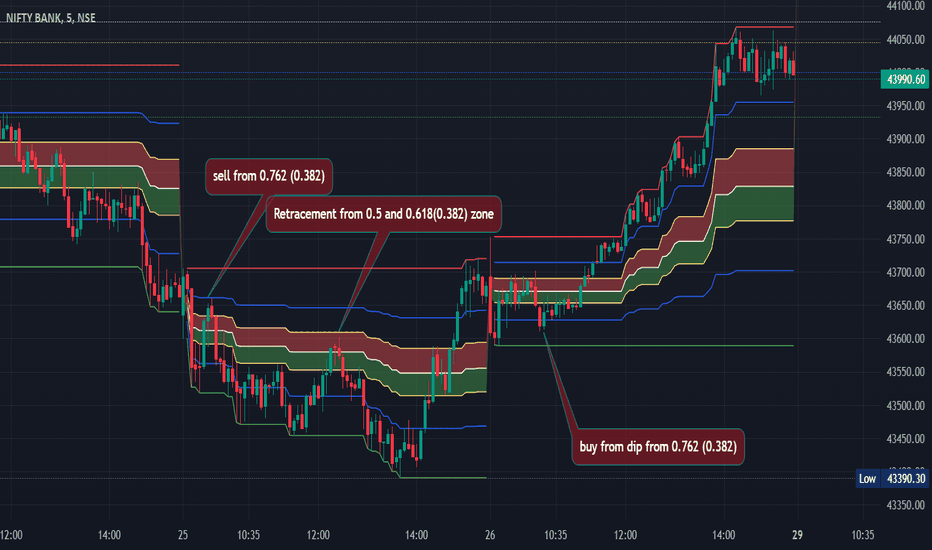

Fibonacci Retracements provide essential guidance during pullbacks, but a projection of where the price might move after the retracement ends can be more revealing. That is where Fibonacci Extensions come into play. In this post, you can get help to understand how to use Fib Extension TradingView.

What is Fibonacci Extension in TradingView

Fib Extensions enable traders to anticipate future price movements and set strategic profit targets when trends resume. TradingView’s user-friendly ‘Trend-Based Fib Extension’ tool makes this task even simpler, maps high-probability price zones, and improves exit strategies accordingly.

The Purpose of Using Fibonacci Extensions

Fibonacci Extensions differ from Retracements by forecasting price levels in the direction of a trend rather than measuring pullbacks. They use key Fibonacci ratios such as 1.272, 1.618, 2.0, and 2.618 to predict potential areas where resistance or support could emerge once price continues its movement in that direction. Here is why traders use them:

Establish Profit Targets

Deliberate profit taking points by setting profit targets that take partial or full profits at key junctures.

Display Trend Strength

Relentlessly uptrends can often surpass or reach beyond the 1.618 extension level, giving way to significant price stalling or reversal in exhaustion zones that form. Eventually, they should serve as exhaustion zones as price could stop or reverse before reaching new highs again.

Three Working Points of How to Use Fib Extension TradingView

Fibonacci Extensions use three points instead of just two, like Retracements do.

Point 1 – Starting the Trend

The point where the impulse moves occurs, i.e., swing low for an uptrend or high for a downtrend.

Point 2 – End of Move

This refers to when the peak of the move occurred before any pullback.

Point 3 – End of Retracement

Where retracement ends and trend resumes.

Step-by-Step Instructions for How to Use Fib Extension TradingView

Selecting the Tool

In TradingView, locate and click on the left-hand toolbar under Gann and Fibonacci Tools to select Trend-Based Fib Extension as the Tool to Use.

Choosing Three Points as Pointers

_To start the trending process, first click the ‘start of trend’.

_Finally, click ‘end’ of impulse move.

_To complete, click on the ‘end of retracement’.

Customize (Optional)

To access settings for drawn levels, double-click them. You may alter line styles, add or delete levels as necessary, and highlight key levels such as 1.272, 1.618, or 2.0, the latter often acting as price markers.

Further Guidance for How to Trade Fibonacci Extensions or Fibonacci Envelopes

Drawing lines is just the start. Here is how you can use them effectively:

Search for Confluence Areas

Combine extensions with technical tools for stronger signals:

- Support or Resistance Levels _ extension levels corresponding with historical zones lend credibility.

- Chart Patterns _ the patterns, such as flags or triangles near an extension, can enhance breakout attempts.

- Moving Averages _ they near extensions add weight and credibility.

- Volume Spikes _ a rise in volume near an extension zone may serve to underscore its significance.

Wait for Price Action

As opposed to entering or exiting at extension levels with blinded precision, observe how price evolves:

- For bullish setups _ watch out for bullish candles such as hammers or engulfing patterns to signal entry points.

- For bearish setups _ look out for signs like shooting stars or bearish engulfing patterns as potential indicators of possible reversals.

Use Higher Timeframes

Fib Extensions tend to perform best on higher timeframes, i.e., 4H, daily, or weekly, where trends become clearer while noise decreases.

Adjust When Needed

As price changes occur, new highs and lows may emerge. Don’t hesitate to alter your extension levels accordingly as the trend develops.

Adequate Risk Management

When setting specific targets, risk management remains essential:

- Establish stop-losses according to your trading plan.

- Consider scaling out, taking partial profits at levels like 1.272 or 1.618, while leaving part of your position open for higher targets.

How to Use Fib Extension TradingView Successfully is an Important Thing to Learn

Fib extensions provide you with an innovative, forward-looking tool to set clear profit goals systematically and confidently in TradingView analysis. By pairing this approach with other indicators and sound risk management practices, they can significantly enhance your trading confidence and rigor. Practice on various assets and time frames, seeking accuracy and confidence to boost your edge.