Last Updated on March 15, 2024 by symip

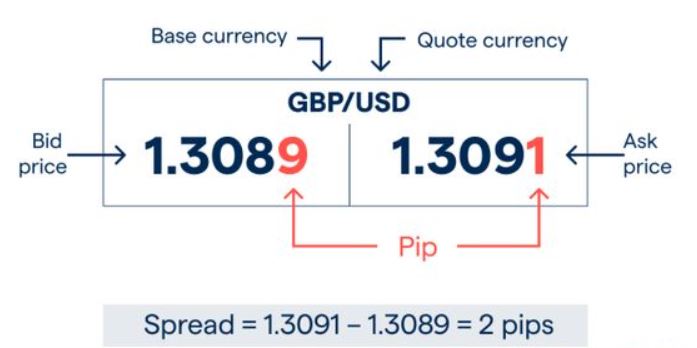

When it comes to forex trading, the variance between the bid/sell price & the ask/buy price represents the spread regarding a currency pair. In any given currency pair, there will always be two prices involved, the bid & the asking price.

• Bid Price

The bid price is the actual price you will be selling the base currency.

• Ask Price

The ask price represents the buying price of base currency.

The base currency will be displayed at the left side of all currency pairs, whilst the variable, counter or quote currency will be on the right side. However, the pairing indicates to what degree the variable currency amounts to a single unit in relation to the base currency.

The quoted buy price will always exceed the quoted sell price, whilst the underlying market price will be in between.

What Does Spread Means in Forex Trading

The majority of currency pairs in forex are traded with no commission. However, the spread will always be the one cost which applies to every trade which you place.

Instead of charging any commission, a spread will be incorporated within the cost when a trade is placed, by the leveraged trading providers, factoring in a higher ask price comparative to the bid/sell price.

The spread’s size can be affected by the following factors:

Forex Trading Spread/What Is Forex Trading Spread by Brokers

- • The currency pair which you are trading

- • The size of the trade

- • The volatility of the currency pair

- • The provider who you are using

Some of the Significant Forex Pairs:

.

- • USD/JPY US dollar & Japanese yen

- • EUR/USD Euro & US dollar

- • USD/CHF US dollar & Swiss franc

- • GBP/USD British pound & US dollar

Pip Spread – Forex Trading: Forex Trading Spread/What Is Forex Trading Spread by Brokers

Pips are used to measure spread; it represents a small movement unit in a currency pair’s price, whilst it is the last decimal point regarding the quoted price, equivalent to 0.0001. This applies to most of the currency pairs, except for the JPY (Japanese yen) where the 2nd decimal point – 0.01, is the pip.

When the spread is wider, there will be a greater variance between these two prices, in general there is low liquidity & high volatility. On the contrary, a lower spread will be indicative of low volatility & high liquidity. Therefore, a lesser spread cost will be incurred when a currency pair is traded which has a tighter spread.

The spread in forex trading can be either variable or fixed. In trading forex pairs, the spread is variable, therefore, when the bid/sell & ask/buy prices regarding currency pairs change, the spread will also change.

Benefits & Disadvantages of Fixed Spread

- • Possible to face requotes

- • Transaction costs can be predicted

- • More appropriate for beginner traders

- • Smaller capital requirements

- • The spread won’t be affected by a volatile market

- • Liable for exposure to slippage

Benefits & Disadvantages of Variable Spread

- • Requotes poses no risk

- • Market liquidity can be revealed

- • A tighter spread is possible compared to the fixed spread

- • With high volatility the spread can widen fast

- • More suitable for experienced traders

- • Exposure to slippage is possible

How The Spread in Forex Is Calculated?

You can calculate the spread by using the buy & sell prices’ last large numbers, in a price quote. When you are trading forex or another asset through a spread betting account or CFD the whole spread must be paid upfront.

This actually compares with regards to the commission which is paid when trading share Contract for Differences (CFDs), which will be payable both when a trade is entered or exited. With a tighter spread, as a trader, you will get better value.

Example of calculating the spread

The bid price–is 1.26738 & ask price–is 1.26748, for the currency pair GBP/USD.

Subtracting 1.26738 from 1.26748 equals 0.0001.

Whilst the spread is established upon the price quote’s last large number, the spread is 1.0.

Trading Strategies & Forex Spread:

An event-driven strategy can be employed by forex traders which is based upon macroeconomic indicators, with the aim of trading the tightest forex spreads & profit from favorable moments.

When traders monitor the economic announcements & the most recent trading news, they can expect changes within the forex trading market and may find opportune entry & exit points whilst opening a position. Thus, this is known as event-driven trading.

Forex Spread Changes

In the scenario where the forex spread broadens significantly, a trader runs a risk of getting a margin call and can be liquidated in the worst-case situation. A notification of a margin call arises when the value of your account is dropping below 100 percent of the margin level. This signals that you pose a risk of not covering the requirement of trading.

Should you reach 50 percent below the margin level, all your positions could be liquidated.

Therefore, it is important to evaluate how much leverage you are trading, taking into account the size of your trading position. In general forex pairs are traded in larger amounts, compared to shares. It is crucial to be always aware of the balance of your trading account when it comes to forex trading spread/what is forex trading spread by brokers.

Forex Spread Indicator

When looking at forex trading spread/what is forex trading spread by brokers, you can strengthen your forex spread strategy by using a trading indicator. This forex spread indicator, a curve on a stock chart, will be showing the spread’s direction, as it is relevant to the bid/sell & ask/buy price.

This assists the trader to visualize the spread within the forex pair over a period of time. Thus, the pairs with the most liquidity will have tighter spreads, whilst the more attractive pairs will have wider spreads.

A lower spread will be applicable regarding currency pairs traded in higher volumes, like the major pairs which contain the USD. Such pairs do have higher liquidity, though it may still carry a risk of broadening spreads, during economic volatility.

In this article about forex trading spread/what is forex trading spread by brokers, we just touched the tip of the proverbial iceberg. We advise you to do much more research online and find a Forex Training Academy where you will be able to enroll for free lessons.