Last Updated on December 11, 2024 by Deon

Staying aware of forex market predictions and trends can be challenging in its fast-moving nature. Therefore, staying informed through reliable gold forecasts from Forex Factory’s widely recognized online platform is crucial to successful forex trading. Here you can learn how Forex Factory Gold Forecast can assist traders to make more informed trading decisions.

Essential Concept of Forex Factory Gold Forecast

Forex Factory has long been known for providing comprehensive resources, including economic calendars, breaking news alerts, and expert technical analysis. Of particular note is its gold forecasts section providing predictions about gold price movements during periods of market turbulence. Economic trends, geopolitical events, and technical indicators participate in making these forecasts.

Importance of Using Forex Factory Gold Forecast

Strengthen Decision-Making

Forex Factory gold forecast gives traders deeper insights into the dynamics that control gold prices, helping them decide more precisely to purchase, sell, or hold their positions.

Spotting Trading Opportunities

Forecasts can provide investors with insight into potential trading opportunities. For instance, analysts who predict an upswing may encourage traders to enter long positions. Conversely, a bearish forecast could signal opportunities to short gold or alter existing investments.

Reducing Risks

Gold can protect from inflation and volatility. Following forecasts helps traders evaluate hidden risks and adapt strategies accordingly, fortifying their portfolios against possible threats to their well-being.

Keeping Up-to-Date With Market Updates

Forex Factory’s real-time news and market updates allow traders to react quickly, taking advantage of changing market conditions. They can grab any favorable opportunities presented.

Getting the Maximum Advantage with Forex Factory Gold Forecast

Understand Your Analysis

To develop accurate price predictions, one needs to go into each forecast’s reasoning deeply and consider the main economic indicators and global events that could impact its price movement.

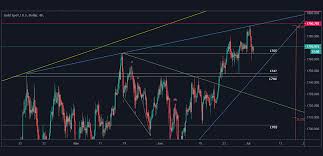

Combine Fundamental and Technical Analyses

While fundamental analysis remains a necessary resource, technical indicators like trend lines, moving averages, support or resistance levels can add an invaluable dimension. They complement forecasts with a comprehensive perspective that makes decisions simpler and provides accurate predictions.

Implement Risk Management Tools

Protect your capital by setting stop-loss and take-profit orders. These instruments help manage losses while locking in gains effectively.

Track Market Sentiment

Market sentiment can dramatically affect gold prices keeping an eye on changes. The forecasts and sentiment will enable you to anticipate and respond quicker when market fluctuations arise.

Forex Factory Gold Forecast Helpful for Navigating Complexities of Trade Market

Forex Factory’s forecasts offer traders important guidance for selecting strategies and managing risks effectively in today’s gold market. By understanding economic forces at work on the Forex Factory platform and taking advantage of all available tools, traders can better navigate its complexities.

Forecasts may help guide decisions but should never replace sound risk management practices that protect investments while adapting to ever-evolving market environments.

Read More About